Regarding , there are step one,481 applications to possess case of bankruptcy for the Singapore and you can 404 orders produced – a significant number considering the brief 5 months duration.

Case of bankruptcy, in a nutshell, is when your debt more you really can afford to invest. There are even a great amount of technicalities inside.

Declaring personal bankruptcy when you look at the Singapore is certainly not what of several manage envision whenever thought aside their profit. Because benefit is unexpected, people who become bankrupt hardly know what doing so you can get out of it or perhaps the outcomes they may face.

Whenever entertaining the notion of filing for case of bankruptcy, anyone often find advice on how they should go on fixing their costs. If you happen to homes oneself in such a situation where you must file for bankruptcy in the Singapore, here’s what you must know.

Whenever Do you really Seek bankruptcy relief From inside the Singapore?

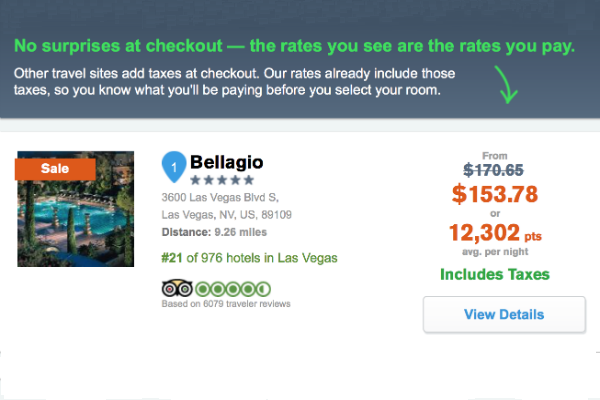

Case of bankruptcy try a legal reputation of people who never pay back bills amounting to help you at the least S$15,one hundred thousand. Yet not, depending on the the latest legislation on the short term actions having bankrupts to bring rescue to debtors regarding financial institutions, extent has been risen up to no less than S$sixty,one hundred thousand up until due to the COVID-19 .

- There can be a decreased chances your in a position to repay your debts completely.

- When there is absolutely no almost every other solution plan together with your financial institutions to help you pay off your debt.

Simultaneously, additionally it is possible for creditors so you can apply for their personal bankruptcy if they don’t think that one may repay the cash which you owe her or him.

Additionally, it is noteworthy you could be made broke by Large Legal even if you will not address your own creditor’s requires.

Wind up struggling with debt? You can look at getting a personal loan that have licensed moneylender Crawfort so you’re able to combine the debt . It’s still very important that you’re confident you might pay back the private loan when you look at the Singapore.

Requirements In order to File for bankruptcy Inside the Singapore

Besides having to meet the standing to be at the very least S$fifteen,100000 personal debt (increased to no less than S$sixty,100000 up until on account of COVID-19), your otherwise the creditor can also be file for one to end up being declared bankrupt for those who fulfill any one of the pursuing the requirements:

- Are now living in Singapore

- Have property from inside the Singapore

- Have been a citizen into the Singapore for at least 1 year

- Has an area away from home from inside the Singapore for at least step one year

- Provides persisted organization in the Singapore for around one year

In the event the bankruptcy software program is from the fresh payday loans Louisiana collector, therefore fulfil one of many following the, you may be regarded as incapable of pay the debt:

- Your fail to conform to a legal demand to spend the brand new loans for at least 21 months (already risen to at least half a year up to on account of COVID-19)

- You fail to conform to a judge-provided execution to have installment

Adopting the evaluation, you can be announced bankrupt lawfully because of the High Courtroom in this 4 to 6 months of your own application.

For effective case of bankruptcy applications, loan providers can recoup an entire number of this new deposit. not, you’ll not feel the deposit came back for individuals who recorded getting personal bankruptcy on your own.

In the case of a refused or withdrawn software, the brand new OA will refund S$step 1,800 to you or perhaps the creditor. The remainder S$50 will go on the administrative will set you back.

What will happen If you Seek bankruptcy relief In Singapore?

When you’re filing for personal bankruptcy isn’t an appealing situation to be in, it isn’t the finish. This is what happens when your file for bankruptcy in Singapore.

step 1. The debt Comes to an end Racking up

After you have recorded to own personal bankruptcy, your welfare end snowballing on your own expense. As a result, your debts is frozen at the a certain amount.

Immediately following you might be announced broke, the new OA commonly ount from month-to-month sum and then make, looking at your own family members’ needs. According to the partnership out of a debt cost bundle, paying your debts becomes much easier.

2. Loan providers Try not to Manage Courtroom Proceedings Facing You

When you seek bankruptcy relief inside the Singapore, creditors indeed commonly allowed to initiate people court legal proceeding up against you to recoup expense ahead of bankruptcy.

3. You must make Monthly Contributions Toward Case of bankruptcy Estate (To blow The debt)

According to the Case of bankruptcy Act, you just like the an undischarged bankrupt will additionally have to fill in good Declaration away from Products, which is track of your own property and you may obligations.

Be sure so you’re able to stick to the brand new installment bundle determined by your OA to repay debtors. A portion of your paycheck would-be automatically paid down to help you creditors and you may small amounts will be presented for you for day-after-day expenditures.

4. You have to Quit Their Assets On Authoritative Assignee (OA)

After you seek bankruptcy relief, assets which can be of value like your car would need to be surrendered and you will liquidated.

This may involve one thing of value to you personally between your car or truck, assets overseas, to help you gift ideas you obtain before your discharge of bankruptcy.

5. Your Name Would be Listed on the Case of bankruptcy Register

Bankrupts are certain to get their title from the bankruptcy proceeding check in, thus someone checking the brand new suggestions will be able to remember that you will be broke. In addition, your own businesses would be notified.

Toward a brighter notice, you can get the identity removed over time of your time based on how you earn from your own case of bankruptcy. Such as, people that manage to repay its target share have their labels eliminated five years immediately following being released.

six. You’ll have Minimal Work Candidates

While you can still be capable keep functioning, you can also face complications getting work, particularly in the new financing globe and public sector . Also, it’s unrealistic that you’ll be in a position to consume a beneficial managerial condition.

7. You simply can’t Traveling To another country Without the Authoritative Assignee’s Acceptance

Bankrupts need inform the new process of law and you can search approval throughout the OA if they must log off Singapore. Apart from explanations regarding your jobs, this is exactly hardly acknowledged.

A broke which journey abroad rather than recognition might be incarcerated upon get back, for up to a couple of years. Likewise, you will find a hefty fine as high as S$ten,one hundred thousand.

Regardless if you are permitted to take a trip (plus the permitted period) might rely on their classification because the a bankrupt.

In general, bankrupts having sufficient carry out are positioned regarding Green Region, if you are those with disappointing conduct are categorised beneath the Purple Zone. Below are types of rights and withheld rights to possess Green Region and you will Red Zone bankrupts respectively.